|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

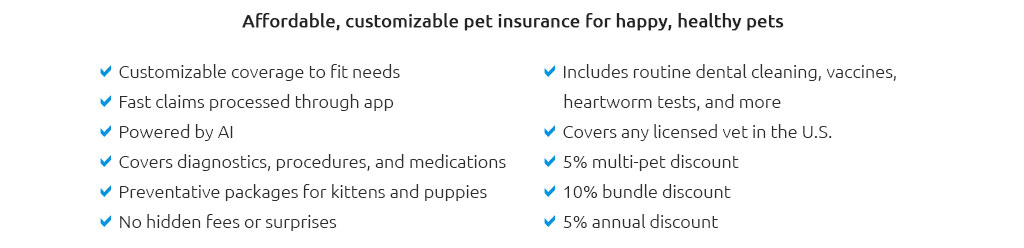

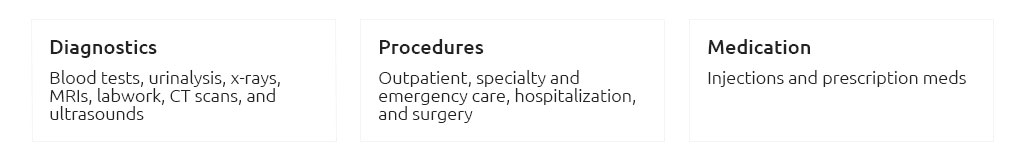

medical dog insurance insights for long-term care and convenienceFrom a researcher's lens, coverage for canine medical needs functions as a financial buffer that smooths unpredictable veterinary expenses across time. The central variables are risk transfer, administrative reliability, and day-to-day convenience in claims and communication. Evidence from pricing patterns and clinic workflows suggests strong practical value, though exact savings will vary with breed, age, and local care costs. What it generally coversMost comprehensive policies target unplanned, clinically necessary care. The highest utility emerges in high-cost, low-predictability events.

Coverage breadth is meaningful, but fine print matters; some items are included only with riders or after waiting periods. What it rarely covers

Cost mechanics and long-term trajectoryPremiums are a function of breed risk, age, location, and inflation in veterinary services. Over a 5 - 10 year horizon, premiums typically trend upward as dogs age and care costs rise; the rate of increase is not fully predictable, but sensitivity testing can bound expectations.

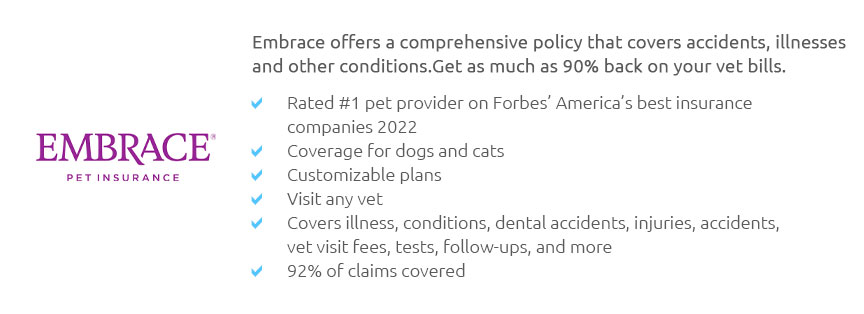

Reliability signals

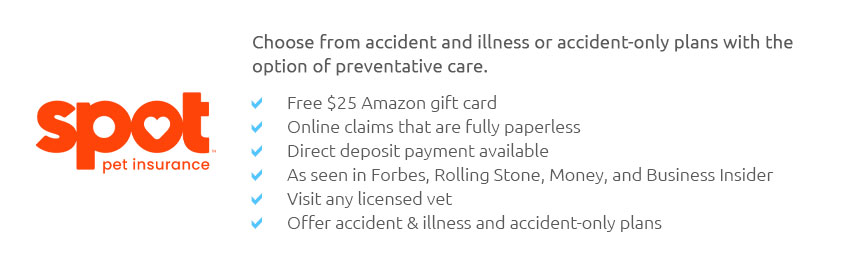

Convenience factors

A brief real-world momentSunday evening, a border collie strains a knee on a trail run; the ER invoices imaging and pain control. The owner submits photos of the itemized bill via an app before bed. Five days later, funds arrive - 80% after the annual deductible - along with a clear EOB detailing line-item approvals. The process isn't glamorous, but the convenience and reliability reduce stress at exactly the wrong time to be stressed. Researcher's comparison checklist

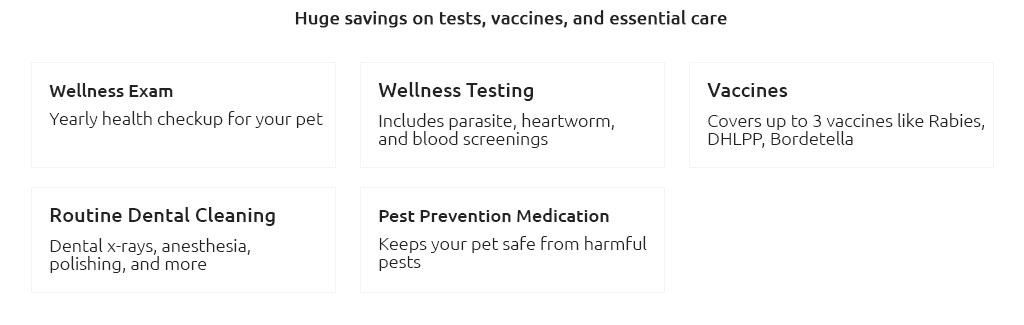

Preventive and chronic careWellness add-ons can simplify budgeting for vaccines, exams, and dental cleanings; their net value is mixed and depends on routine-care prices in your area. Chronic conditions (e.g., allergies, diabetes) are often covered after waiting periods and remain covered if enrollment stays continuous. Aging and breed riskLarge breeds and certain predispositions (orthopedic, dermatologic, cardiac) shape cost curves. Early enrollment reduces gaps and pre-existing disputes. Over time, premiums will likely rise; selecting a sustainable deductible can keep monthly outlay manageable while maintaining high-impact protection. How claims usually unfold

Budgeting approachA pragmatic mix pairs a higher deductible with strong catastrophic coverage, plus a modest reserve fund for minor issues. This balances predictable premiums with the reliability of high-limit protection. The day-to-day convenience of quick claims and direct pay often matters as much as the reimbursement percentage. Terms to decode fast

Ethical and experience notesInsurance reduces the temptation to delay care, which can worsen outcomes. It also lowers decision friction during emergencies. While no policy anticipates every scenario, consistent claims handling and clear communication materially improve the caregiving experience. Bottom lineViewed across years, medical dog insurance functions best as a resiliency tool: it shifts severe, irregular costs into manageable, more predictable payments. Favor policies that demonstrate operational reliability and everyday convenience, and validate assumptions with your dog's specific risks and local price environment.

|